Like many diehard baseball fans, I have a bit of a memorabilia collection. It’s a fun hobby, curating and celebrating moments throughout the history of the sport. The display also makes for a perfect ambience when friends and family come to my home to watch a game.

Recently, several items from the personal collection of Johnny Bench went up for auction. While the majority of the items were far outside of my price range, there were a few pieces that I felt like I could reasonably afford, so I made the drive to Louisville to see if I could add anything to my collection.

It didn’t take long to realize a simple truth: I was way out of my depth. My belief that I could be competitive in my offers for these baseball relics was quickly swept away, as my high bids were consistently beaten by large margins. As I watched these items disappear one by one, often several thousand dollars more than the estimated value, I found myself laughing at the ridiculousness of the situation. Even though I had saved up and brought a lot of money with me, I was competing against a different league of spender.

In other words, I did not belong with this group.

My experience at the auction is a metaphor for the current ownership of the Cincinnati Reds.

I don’t know if you’ve been watching free agency this year, but there have been several monster contracts handed out. Carlos Correa is the most recent, signing a 12 year, $315 million deal with the Mets. National baseball writer, Ken Rosenthal, cites changes in ownership spending habits as the impetus behind this change.

“This is a new breed of owner, operating under a new collective-bargaining agreement that reflects the union’s success in raising the luxury-tax thresholds and staving off harsher penalties. Cohen took over the Mets in late 2020. Seidler became the Padres’ control person not long after that. Middleton became a 48 percent shareholder in the Phillies in 2014 and their control person in 2016. With any luck, the Nationals and Angels, both currently for sale, will be bought by like-minded individuals or groups, and the turnover will continue with the Reds, A’s and Pirates, to name three clubs that need a change.”

Wow. Even national writers are joining the #SellTheTeamBob movement.

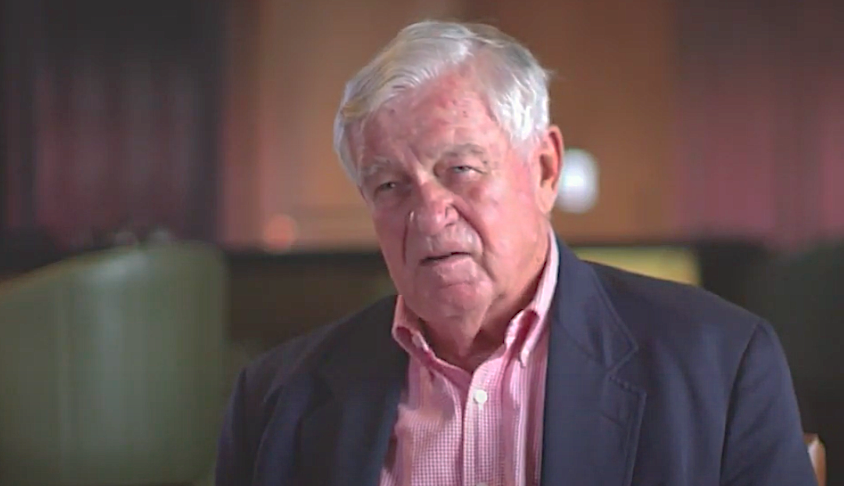

Between failure to field a competitive team, lack of spending and Phil’s 2022 Opening Day tirade, Reds ownership has captured media attention for all the wrong reasons. In light of this, let’s explore Castellini’s time as the Reds owner and discuss if selling the team may be the best option for him.

Castellini’s Wealth (or lack thereof)

In 2006, the Castellini led ownership group acquired the Reds for $270 million. Since then, the value of the club has grown by 340% to reach roughly $1.2 billion. In spite of this growth, Castellini is reported to have a tiny net worth in comparison with other MLB team owners.

If you can’t see it, that’s Castellini at the far left side of the graph in red. (When I was making this chart, I had to zoom way in to click the bar and change the color. That’s how small his relative net worth is.)

It’s worth noting that the $400 million estimate for Castellini’s wealth a bit old. It’s been cited at least since 2017. As the value of the organization has grown since then, it’s possible the Reds owner’s net worth has also increased. You also have to factor in the financial blow of the pandemic to his wealth. Business decisions outside of baseball suggest Castellini’s non-Reds business might not be doing so well. For example, it was recently reported that The Castellini Group eliminated 150 jobs at its Campbell County warehouse.

Like every major league team, the Reds took a financial hit in 2020 due to COVID, with Forbes estimating its operating income (a company’s profit after deducting operating expenses) falling to -$47 million. In 2021, Forbes estimated the Reds’ operating income of the team to be only $400,000 — essentially breakeven. The club was unable to recoup its losses from the previous year.

Just before COVID hit, Cincinnati’s payroll was projected to be above $145 million, which was above average for an MLB team. But as we head into the 2023 season, the Reds payroll projects at $78 million — a $67 million drop. For context, the league average payroll last year was $150 million. What happened? Stick with me here, because it’s a bit complicated.

Based on the Forbes information, the Reds (prior to 2020) were enjoying an average operating income of $15.6 million a year. From 2020-2021, however, they experienced an average loss of -$23 million (-$47 in 2020 and gaining $400,000 in 2021). If you retroactively split the $67 million the Reds are saving in 2023 across both of those years, you’d see an average operating income of about $10 million, which is more in line with what Reds ownership has experienced since buying the team.

In case you’re wondering, the 2022 data is not publicly available just yet, so we can’t say for certain what happened that year. With plummeting attendance numbers, followed by more offseason payroll cuts, it’s safe for now to assume that the team’s operating income was still not up to historical expectations.

If you missed the insight in all the math, here’s the shorthand: By saving money on payroll this year, the Reds are attempting to recoup their operating income for 2020 and 2021.

A wealthier owner (or ownership group) would have been able to take this loss on the chin, leveraging his or her wealth to continue competing. Unfortunately, this is not the case with our ownership group, and the financial losses sent the franchise into a tailspin. If I were the owner of the Reds (assuming a similar level of wealth), I likely would have reacted in similar fashion. This underscores the need for a wealthier owner who could more easily absorb financial losses and continue building a winner.

It’s worth noting that, while Forbes did the best they could examining the team’s operating income, it’s not a perfect estimate. The team also has a wide variety of income sources, including ticket sales, regional media contracts, jersey sales and more. The actual figures for the teams financials are likely different than Forbes’ estimate.

The vast net worth of Steve Cohen throws off the shape of the graph a little bit, so I also wanted to compare the Castellini net worth to that of the average and median MLB owner. His wealth, using the $400 million figure, is still dwarfed by the Reds competitors.

Here are some interesting statistics for you:

- The average MLB owner has a net worth almost 9 times larger than Bob Castellini.

- The median MLB owner has a net worth 8 times larger than Bob Castellini.

- The net worth difference between the average MLB owner and Bob is 3.14 (Pi!) billion dollars.

- If you took that same $3.14 billion and created a new MLB owner, his/her net worth would be 7.8 times larger than Bob Castellini’s.

Let that sink in for a moment.

Because it can be difficult to wrap our minds around wealth of this level, let’s make another comparison using typical American households. According to data from the Federal Reserve, the median American family has a net worth of $121,700. If the median MLB owner had this same net worth, then Bob Castellini’s net worth would be only $13,500 putting him in the 25th percentile in terms of total wealth. Wealth has no correlation with one’s value as a human being, but this puts Bob and Phil in a context that we (or at least I!) can more easily wrap our heads around.

The Complicated Ownership Structure of the Reds

Although Bob Castellini is the designated face of the franchise, the ownership structure of the Reds is more complicated. It has been estimated that the Castellini family owns somewhere between 15-20% of the team, with the remainder split among an ownership group comprised of 13 individuals and several companies and investment groups. Their combined net worth is not publicly available information. To make things more complicated, not all of the owners have voting shares.

When the Castellini-led ownership group acquired the team, they split the voting shares. Of this group, Bob Castellini has the majority, giving him the controlling interest in the team. Several years ago, these owners decided to take on new owners. These newer owners did not receive any voting shares, though. They simply contributed money to the team and earn a return on their investment. During his time with the Reds, the Castellini family have never gone back to these investors to ask for more money, even though the value of the team has gone up significantly.

The failure to produce a competing team is more than just a Castellini problem. The other owners of the team, primarily those with voting shares, should be facing the same criticism and pressure to sell the team.

Fighting With One Hand Tied

With this context, it makes sense why the Castellini family feels like it cannot compete on payroll with other teams and can be competitive only through better scouting and player development. After all, that is the cheapest way to build a team. There is a major fallacy in this logic, though. Every other team invests in scouting and building through player development. In addition, most others also build through player acquisition in free agency or with long-term contracts of home-grown talent.

Think about it this way: Two UFC fighters meet in the octagon. One fighter competes under the rules of professional boxing, while the other fighter is free to box, kick and grapple. The Vegas odds would heavily favor the second fighter in this scenario. The only way that the first fighter can win is if their boxing skill is vastly superior to the abilities of the second fighter.

If the Reds won’t sign the same size checks as other MLB teams, they’ll be as effective as the UFC fighter who only relies on boxing. They’re like I was at the Bench auction in Louisville. The only conclusion is it’s time for the Castellini family to sell the team, because they are out of their depth financially. It’s time to move on.

Track Record of Failure

Whenever fans complain about their team’s owner not spending more money, people point to teams like the Rays as a counterargument. “You don’t need to spend money,” they’ll say. “You just have to play smart.” The truth is, these people have a legitimate point. Tampa Bay and Cleveland have become the gold standard in MLB for fielding low budget competitive teams.

As a Reds fan, though, I have no confidence in this group’s ability to execute on this strategy. Ever since Castellini bought the club, he’s utterly failed to produce a competitive team, and in spite of promises to bring a championship to Cincinnati, there is a strong argument that the Reds have become the worst franchise in baseball. Don’t believe me? Check this out:

Since 2007, only 5 teams (Padres, Royals, Pirates, Marlins and Orioles) have lost more games than the Reds. In the last ten years, only three teams (Tigers, Rockies, Marlins) have lost more games than the Reds. Of all of these teams mentioned, only the Reds have not advanced in the postseason.

The Reds are the perfect (or rather imperfect) blend of consistent losing and failure to advance in the playoffs.

As Bill Parcell’s famous saying goes, you are what your record says you are. Losers.

Conclusion

In recent years, baseball has changed, with ownership wealth continuing to climb. It feels strange to say that someone with a net worth of $400 million is poor, but in this context it’s accurate.

This would be an optimal time to sell the team. The contracts of Joey Votto and Mike Moustakas are about to drop from the Reds payroll. The club has built one of the highest ranked farm systems inMLB. This would make the Reds a more attractive acquisition to wealthy individuals who could take this team to the next level by combining aggressive spending with the premier prospect pipeline.

This looks like a win-win to me. The Castellini family sells the team for a huge pay day. They no longer have to worry about the eternal disdain Reds country is directing toward Phil. And most important, the players and fans have the chance of getting an owner who has the ability to compete for the top talent in today’s game.

The solution that makes the most sense is for the players and owners to agree to a salary cap. The current structure is driving fans away from the game.

Thanks for reading and for your comment. Unfortunately, the Player’s Union will likely never agree to a salary cap. Even if they did, it would likely be so high that it wouldn’t change things dramatically. I’m not privy to those conversations, though, so it’s possible that I’m wrong.